Trading has become increasingly accessible to individuals with the rise of digital platforms and market awareness. But accessibility does not guarantee success. To trade effectively, understanding market behavior, strategy execution, and proper use of tools such as a Trading App and Demat Account is essential. Whether you’re a beginner or seeking to refine your existing skills, applying well-structured strategies can significantly influence your long-term outcomes.

This explores practical trading strategies that align with real market conditions. Each approach focuses on planning, analysis, and execution rather than speculation. As you explore these methods, remember the importance of a secure Demat Account and a reliable Trading App to execute trades efficiently and track performance.

What Makes a Trading Strategy Effective?

Before diving into specific strategies, it’s important to understand the core qualities of an effective trading plan:

- Clarity: Clear entry and exit rules based on objective criteria.

- Consistency: A method that can be applied under various market conditions.

- Risk Management: Includes position sizing, stop-loss placement, and capital protection.

- Adaptability: Can evolve based on market feedback and performance reviews.

An effective strategy doesn’t promise success on every trade, but it minimizes emotional decisions and maximizes consistency.

1. Trend Following Strategy

Overview

Trend following is one of the most commonly used strategies across different financial markets. The principle is simple: identify the market’s direction and trade in that direction.

How It Works

- Use technical indicators such as moving averages to determine trends.

- Enter the trade when the asset price breaks above or below a moving average.

- Exit when the trend weakens or reverses, typically indicated by price crossing the average in the opposite direction.

Why It Works

Markets often move in extended trends due to macroeconomic developments, and this strategy capitalizes on that momentum.

2. Breakout Strategy

Overview

The breakout strategy focuses on capturing significant price movements once an asset breaks through a defined support or resistance level.

How It Works

- Identify a trading range using historical price data.

- Place a buy order above resistance or a sell order below support.

- Confirm the breakout with volume analysis before committing fully.

Why It Works

Breakouts often signal the beginning of a new trend and can offer excellent entry points if supported by volume and broader market sentiment.

3. Swing Trading Strategy

Overview

Swing trading seeks to capture gains from short- to medium-term movements in a stock’s price, usually spanning a few days to several weeks.

How It Works

- Use chart patterns, candlesticks, and momentum indicators like RSI or MACD.

- Enter the trade when price patterns suggest a reversal or continuation.

- Hold the position until the next price swing or signal suggests an exit.

Why It Works

It balances the intensity of day trading with the patience required for long-term investing, making it suitable for traders who can dedicate part-time attention.

4. Mean Reversion Strategy

Overview

This strategy is based on the idea that prices tend to revert to their historical averages over time.

How It Works

- Identify stocks that have deviated significantly from their moving averages.

- Use technical indicators like Bollinger Bands to determine deviation.

- Enter a trade anticipating that the price will revert back to the average.

Why It Works

Market prices are often influenced by temporary news or sentiment, causing overreaction. This strategy aims to profit from corrections.

5. Scalping Strategy

Overview

Scalping involves executing multiple trades throughout the day to capture small price changes.

How It Works

- Focus on high-liquidity assets with tight spreads.

- Use a Trading App with real-time data and low latency.

- Keep each trade open for seconds to minutes, with strict stop-loss settings.

Why It Works

Small but frequent profits can accumulate significantly over time, provided transaction costs are low and execution is fast.

Tools That Support Effective Trading

Trading App

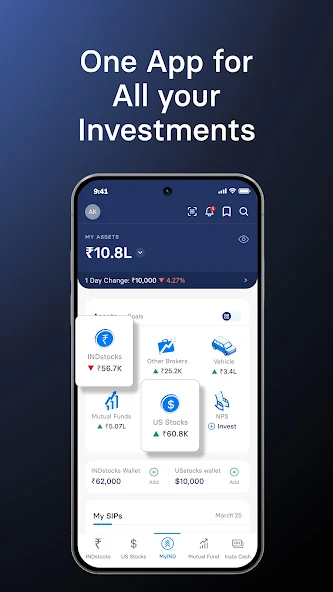

A reliable Trading App is essential for real-time monitoring, quick execution, and access to analytical tools. Look for features like:

- Customizable charts

- Alert notifications

- Risk management tools

- Secure and fast order execution

Demat Account

A Demat Account is necessary for holding securities in digital form. It simplifies the settlement process and is mandatory for most stock trades. It should offer:

- Easy integration with trading platforms

- Minimal maintenance charges

- Transparent transaction history

- Safe, regulated storage of assets

Risk Management: A Non-Negotiable Element

Regardless of the strategy you adopt, managing your risk exposure is non-negotiable. Key principles include:

- Setting stop-loss orders to cap potential losses

- Diversifying your portfolio across sectors

- Avoiding over-leveraging your positions

- Allocating only a small portion of your capital per trade

Even the most well-tested strategy can fail in unpredictable market conditions. Risk management keeps your capital intact, allowing you to stay in the game.

Conclusion

Success in trading is rarely a result of luck. It is often the product of disciplined execution, thoughtful planning, and continuous learning. Strategies like trend following, breakouts, swing trades, mean reversion, and scalping have shown consistent potential when implemented correctly. However, none of them is a one-size-fits-all solution. The best strategy is one that suits your risk tolerance, time availability, and market understanding.

Before deploying any strategy, ensure you have a functioning Demat Account and a reliable Trading App. These tools are not just technical requirements but crucial parts of your trading setup that can impact your execution speed, data access, and decision-making.

Trading is not about predicting the future but preparing for it. With the right mindset and structured strategy, you can navigate market fluctuations more effectively and build a disciplined approach to trading.