Online investments in this digital era have really transformed the way one handles or develops financial growth. With various tools and a number of platforms to invest through, investing has become easier than ever. However, one must be very aware not only of the advantages but also of the safest manners of investment in order to be successful in investment journeys. This blog shall delve into the advantages of online investing and cover some tips for safe investment practices.

Benefits of Online Investing

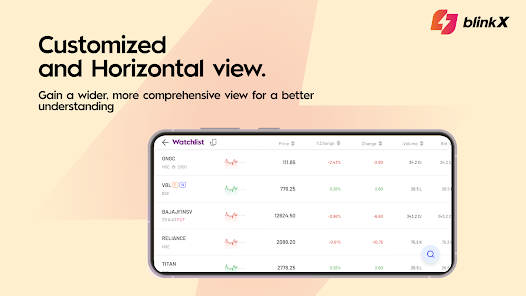

- Convenience and Accessibility: Most of the investment platforms online, such as stock trading app for beginners, are helpful for stock exchanges & beginning stock traders, and possess unparalleled convenience. While one can operate and maintain a portfolio, execute trades, and monitor market trends within the comfort of one’s house, such accessibility makes investment more reachable for beginners and swift in decision-making for seasoned investors.

- Low Costs Conventionally, investment came with high charges in the form of fees and commissions by the brokers. Online platforms disrupted the model as they offer low transaction costs and sometimes commission-free trades. This reduction in fees means investors can keep more of their returns and reinvest them for further growth.

- Real-time market data on platforms like Sensex and Nifty give investors greater insight into decision-making. Besides, the ability to view updates on live market trends, current stock prices, and economic indicators enables each investor to take quick action on the market movements and make strategic decisions effectively.

Various investment options are available, from equity trading, mutual funds, Sensex nifty, and exchange-traded funds. For this reason, investors can have an appropriate portfolio matching their risk tolerance that will fit their investment goals. Investors of all types can get their picks, from stocks with huge growth potential to more conservative, income-yielding instruments.

Safety Tips for Online Investment

- Go for Reputable Platforms: When you choose a stock trading application for beginners or select another online investment platform, make sure you get an application with a good reputation. The reviews are good, security is good, and with all relevant regulatory approvals, your investments are secure.

- Educate Yourself: Before you begin with equity trading or any other form of investment strategy, take ample time to educate yourself about markets. An overall view of fundamental ideas in market indices- Sensex and Nifty- your stock’s valuation and trading strategies will help greatly in making your investment decisions way better with minimum risks.

- Monitoring and Review Regular monitoring of your investments and reviewing your portfolio will enable you to keep your investment strategy in line with your goals. Most online platforms have performance-tracking tools that can guide one in making adjustments. It’s good to know how the markets are trending and be ready to shift gears when needed.

Conclusion:

Online investing websites offer a number of key benefits, including convenience, reduced costs, and up-to-the-moment market information. One can securely and successfully invest online by selecting decent web platforms, being properly informed, making reasonable investments at the start, and staying alert. This is regardless of whether it’s an online stock exchange app or a stock trading app for beginners. Success would relate to informed decision-making and strategic planning.